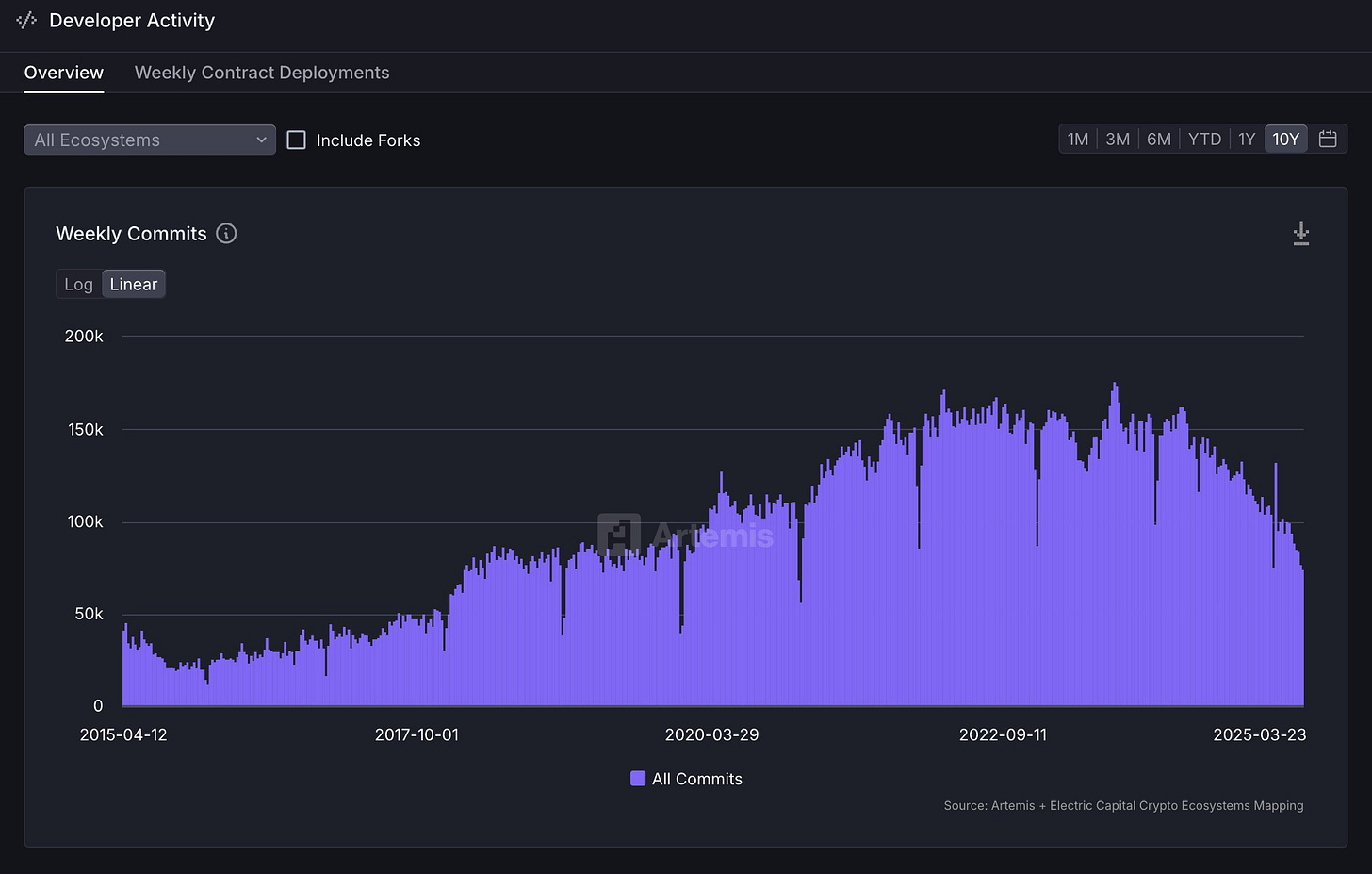

I present to you the most important and concerning chart in crypto.

This chart has received a lot of attention on X, and for good reason. If developer activity is really on the outs, crypto beyond bitcoin, stablecoins, and pump.fun is simply put extremely cooked.

Unfortunately, the overwhelming consensus is that crypto is just that and developers are mostly to blame for failing to create meaningful apps, with the market as a whole also receiving a bit of shade for chasing harmful speculative pumps over and over again like a bunch of coked out monkeys. This sentiment is shared even by those with a more pro-developer slant.

While this cycle, if you can even call it that, has undoubtedly been disappointing, I don’t think developers are mostly to blame. Instead, I think the VCs are mostly to blame, who, without their rape train of low float high fdv L1s, have mostly retreated from the space.

Nowhere to be found

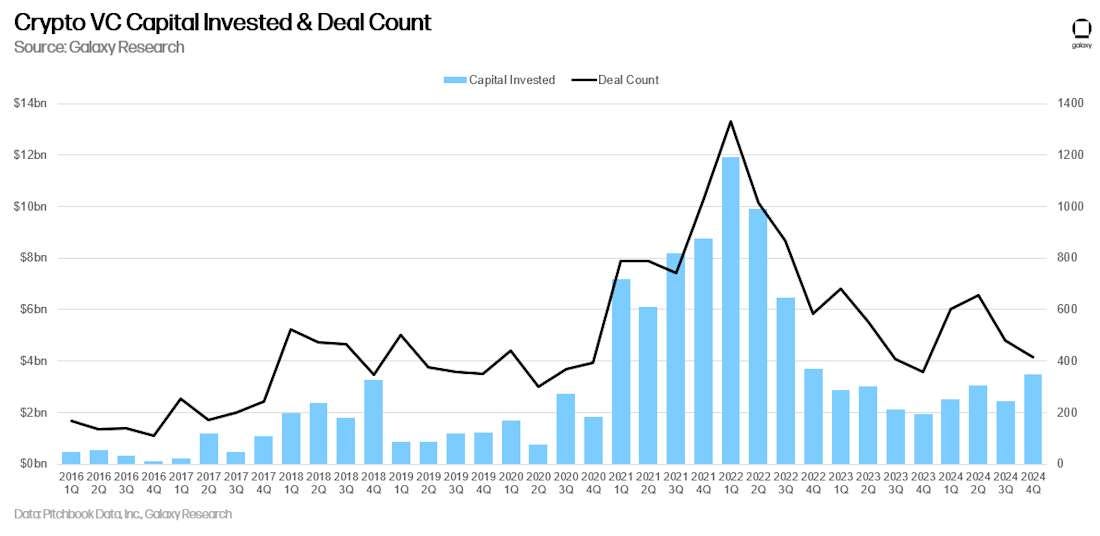

Although developer activity is beginning to tick down, it has stayed relatively strong. You can’t say the same about VC activity and funding. Even in 2024, when bitcoin was on a rocket ship to $100K, VCs barely invested more than in the barren 2023.

The data looks even worse when you look at just angel, pre-seed, and seed rounds, also known as the earliest rounds where VCs should be most willing to fund the most daring ideas.

It’s an absolutely striking graph considering how strong developer activity was and still is, especially at the earliest stages.

But it makes sense when you realize that VCs have basically given up on crypto.

Why VCs are pulling back

If you look at those graphs, you can clearly see that the peak of VC excitement was in 2021 and 2022. For those who weren’t paying attention at that time, this was the peak of crypto mania in general. People genuinely thought DeFi, NFTs, and the Metaverse were going to change the world, and because ChatGPT wasn’t a thing yet, crypto wasn’t just the cool kid on the block; it was the only kid on the block.

Unfortunately, DeFi, NFTs, and the Metaverse did not change the world (yet?), so VCs from that era had three outcomes:

Invest in the “cool” stuff, and get fucked.

Invest in the “free money” stuff like L1s and bridges, and make a fuck ton of money.

Some combination of both.

This has led to multiple problems hamstringing VC activity today. One, any VC who got burned on the “cool” stuff now treats most crypto deals like it’s covered in fleas. Two, there really is no need for the free money stuff anymore. You don’t need 75 L2s or 23 bridges, so these deals are just not available anymore. And three, even if they were, investors have wisened up to these predatory practices and so treat these deals and their respective tokens like they are covered in fleas. For better or worse (it’s for better), there is no more exit liquidity.

The result is that VCs are too traumatized to invest in the stuff regular people actually want to buy and use, and are unable to invest in the stuff they would prefer to invest in. Thus, the slowdown in investments.

VCs have lost faith

This point really needs to be hammered home, so I’m giving it its own section.

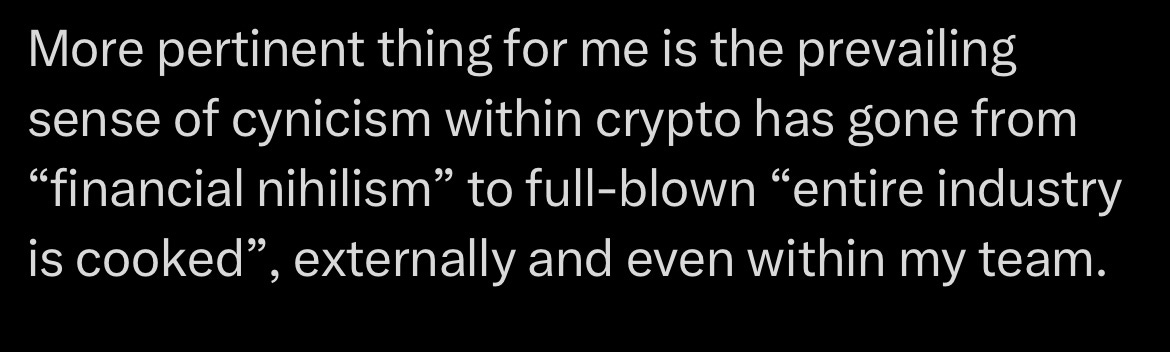

Besides the retards who lost their life savings on memecoins and Anteater, nobody is more pessimistic about the future of crypto than the people who are supposed to be investing in it’s future.

Here’s 0xENAS, aka Darryl Wang, from Tangent Ventures

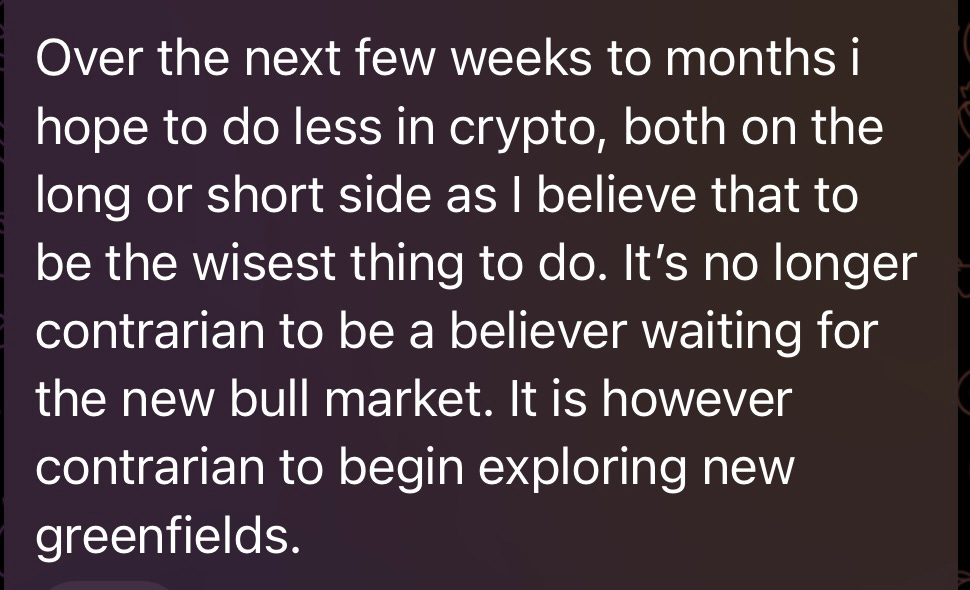

Andrew Kang from Mechanism Capital.

Jason Choi from Tangent Ventures.

Even Alliance, probably the best and definitely the most active early-stage investor in the entire space, is beginning to pivot out of crypto, with 30% of their recent batch being pure AI startups and their latest hackathon soliciting ideas in “crypto, AI, robotics, and new frontier concepts.”

It’s anecdotal, I know, but I’ve experienced some of this myself. When I pitched an admittedly not very good idea to investors, I was surprised to hear criticism not on the merits of the idea itself, but on it not being speculative enough. This confused me at the time, but I’ve since realized that if you view crypto as nothing more than ponzi vaporware, a path to an immediate payout is a de facto requirement if you are to invest.

It turns out I’m not the only one who has experienced this, which is good for my credibility but bad for the rest of us.

On some level, I don’t blame them. Although I believe for many, if not most, VCs, the primary reason they were in crypto was the same reasons a shark goes to salmon-infested waters, many of them definitely believed in the vision and ethos of crypto. However, their job is ultimately to make money, and making money in crypto has gotten much harder for them for the reasons I explained earlier, especially compared to the green grass of AI, robotics, and other frontier concepts.

Is it possible that due to some combination of crypto brain drain to AI, general negative sentiment, and/or a simple lack of good ideas has led to a serious dropoff in investable early stage ideas? Of course, but that story is hard to believe when the applications to a crypto accelerator is up only. It’s far more likely that VCs are just not interested in the space right now, and treat the deals they see accordingly.

This is extremely bad news for anyone who cares about the future of crypto, because, like it or not, we need VCs if we are ever to be wildly successful.

Why VCs are important

The purpose of venture capital, the whole reason why it’s even a thing, is to provide capital to risky opportunities that traditional finance institutions overlook. Venture capital is the reason, or a large part of the reason, you have semiconductors, insulin, mRNA vaccines, ChatGPT, social media, web browsers, iPhones, Spotify, Uber, and the list goes on and on. It’s their money that got these ventures off the ground, and most importantly, gave the founders time to figure out exactly what success looks like.

Crypto is no different. Crypto startups need enough money to launch and repeatedly iterate if they are to be successful.

Take Polymarket, one of the two breakout crypto apps of this cycle, along with pump.fun. Polymarket raised a seed round in October, 2020. They then didn’t raise again until 2024. Here is their monthly active user count for that time period.

For four years, Polymarket gained basically no traction. It’s an almost certainty that they would’ve died without the seed funding, and that would’ve been terrible not just for the crypto ecosystem, but the world as a whole. Now, ask yourself, if Polymarket were still in its 2020 form, would that be a deal VCs invest in today?

Why ICOs and “fair launches” aren’t the solution

One popular retort is that founders can simply get the liquidity they need from launching a token.

I don’t buy this for multiple reasons.

Tokens are valued mostly on attention, especially early. So launches only gain traction if you are already a niche internet celebrity. If you’re not, you’ll just join the literally 9 million other coins in the pump fun graveyard.

Launching a token fundamentally changes the founder’s job. The beauty of private funding is that once you get the money, you can put your head back down and focus on building. But if you have a token, the fate of your startup is now, in the eyes of the market, tied to the price of that token. So, instead of focusing all your energy on building the future, you are on X desperately trying to pump your token.

It’s really easy for token launches to get sniped, which basically guarantees their demise from the jump.

In the crypto world, fairly launching a token means giving away all of the equity in your startup, which kills the eventual payout for the founders and makes it much harder to recruit talented employees.

You have to deal with the LA vape cabal.

Think of it like this. Telling crypto startups to fund themselves via a token launch is like telling a biotech startup to fund themselves by selling shitty supplements. It’s a waste of time, and, in the end, counterproductive.

Conclusion (VCs, don’t give up yet)

At this point, one of two scenarios has to be true. Either we are still early and mainstream adoption is still possible, or crypto is rubbery-rare cooked. The latter could most definitely be true. Crypto has been around for 17 years now, VCs have invested $112B across 6095 investments, and I still have to write this article.

But, I don’t think we should give up on the dream just yet. Sometimes the best meals require a slow burn. Just look at Polymarket, or, better yet, AI. AI has gone through two major “winters” that combined spanned almost 20 years, and now everyone and their mom can’t shut the hell up about “agentic systems.” Hell, Knower just wrote like 20,000 words on the damn thing.

In either case, it’s impossible to know with certainty where we are. The only way we can find out is if VCs continue to invest in crypto.

It’s contrarian and frightening, I know. But isn’t that where the real money is made?

I feel like some of the skepticism of crypto is that it has yet to lead to anything really world-shifting. Even in 17 years. By contrast, if you look at social media or LLMs, those had already reshaped the world within a few years. So if I were a VC and I wanted to bet on something with upside, I’m not going to be as interested.

Developers are at fault for not creating meaningful dApps? What the hell.

At least before, profitable and impactful were consequences now it’s the entirety of meaning?

The scope will shrink and some tech-brahs are going to learn some Rust or at least prompt it for MCP’s to remain. The Rest is good riddance honestly.

Treating a decentralized ecosystem with centralized non-sense is not only meaningless but extractive.