People are really hyped that Apple is now forced to allow NFT and crypto payments in iOS apps.

I think this will lead to a boom in crypto payment apps (paying with crypto from your phone, etc.), but I’m not as bullish on consumer apps in the way they are usually interpreted. That is, I’m not bullish on speculation apps.

Up to now, crypto consumer has meant trading apps, and they have not taken off for a reason deeper than Apple’s draconian rules: trading is inherently zero-sum, and most people lose money.

Take Vector, a trading app from the team behind the popular NFT marketplace Tensor. They tried really hard to capitalize on memecoin mania, and I’ll admit it, the app is pretty cool. It’s aesthetic in a way that most crypto apps aren’t, it’s smooth to use, it has some cool features like copy trading, they clearly put a lot of time into their branding and marketing, and, again, the founders have already been successful in the past.

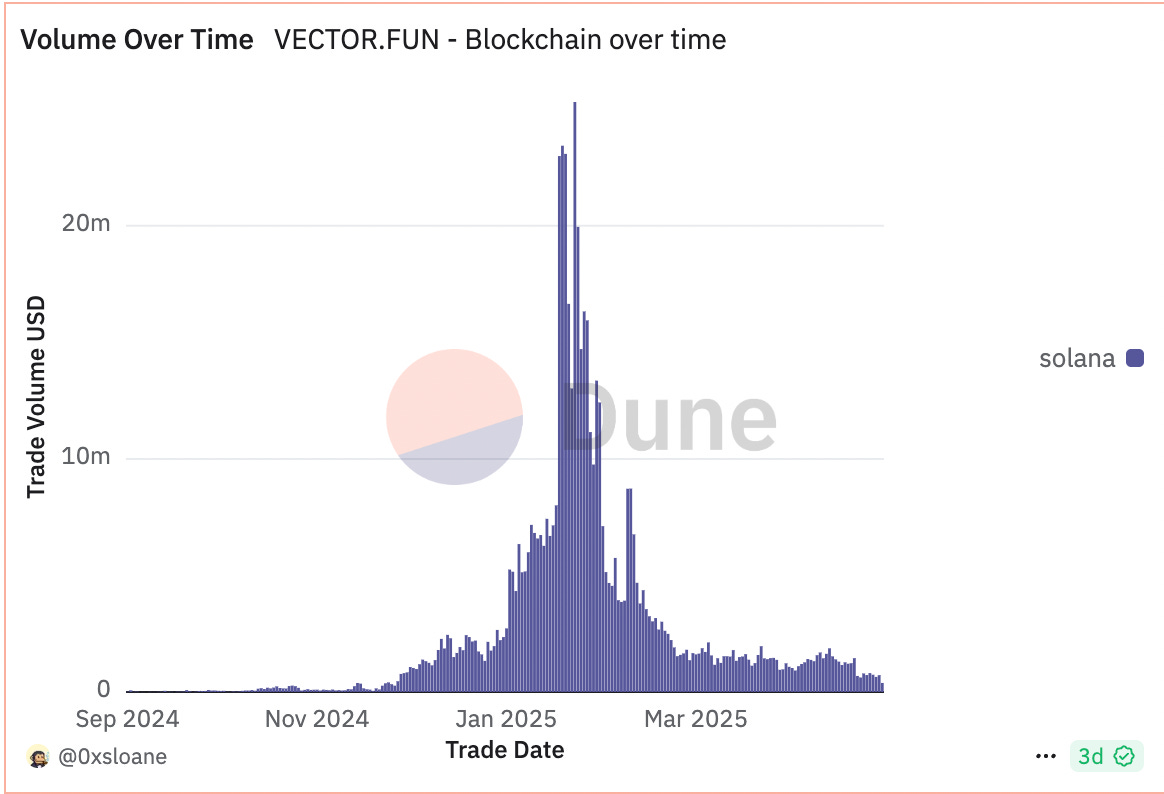

Still, their usage looks like this.

Why? Because this is the homepage.

The hope would be that the hope of joining the top trader leaderboard (everyone up there is up multiple millions just this week) would keep people coming back, but it’s just not going to happen if most people get cleaned out in the process.

Unfortunately, this is just the nature of trading. A few people make a lot of money, and everyone else loses. Take Pump Fun. Only 3% of all people have made over $1,000. Over 17,000,000 people have traded on Pump Fun. Unsurprisingly, Pump Fun’s volume has completely dried out.

It’s the same story for the mobile memecoin trading app Moonshot.

Trading apps will always shine bright and die fast, because the very nature of trading is that most people lose money, and no amount of gamification or tweaking on the margins can change that.

There’s a reason most people just buy and hold.

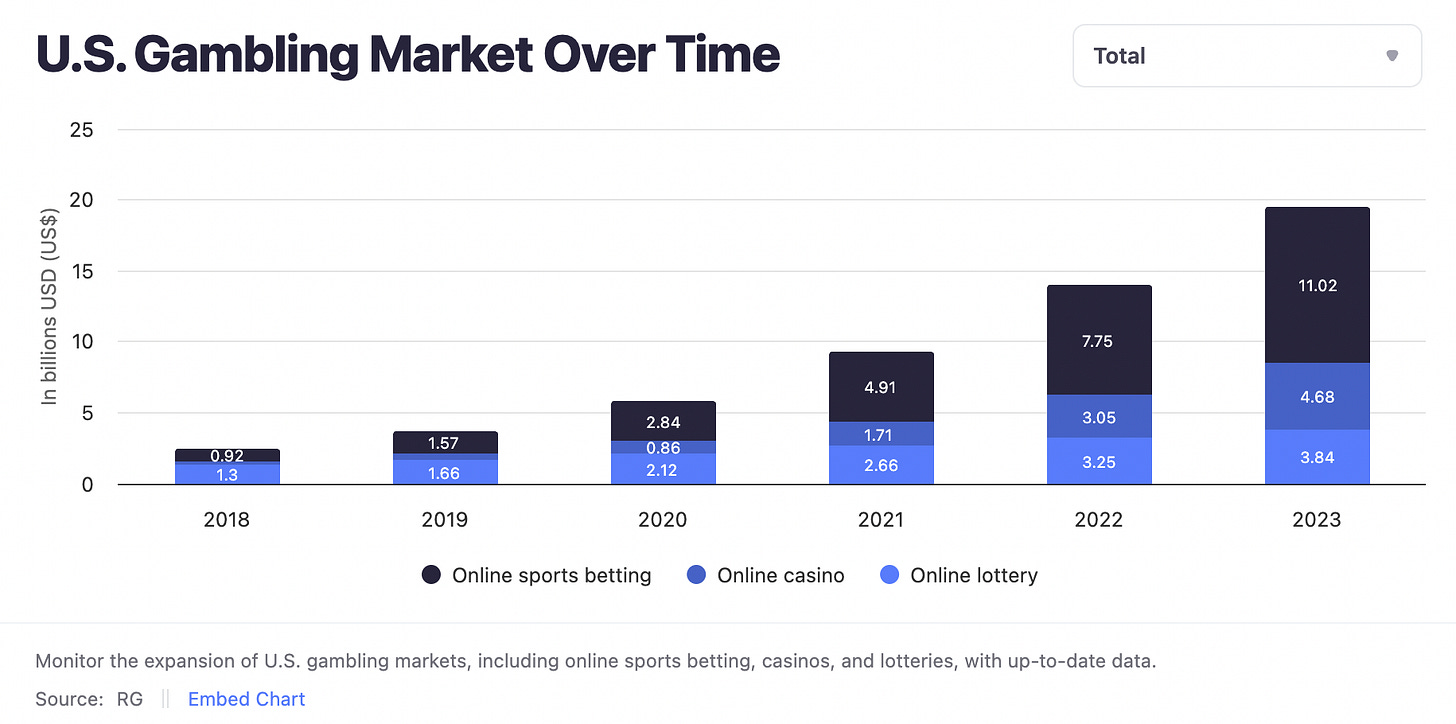

But what about sports betting?

One retort could be that online sports betting continues to grow even though sports betting is similar to trading in the sense that most people lose money.

But sports betting is different from trading in a key area: people already like (and often love) sports. In other words, gambling is just an addition to an activity people were going to do anyway. So, even if they lose money, they still have fun.

Trading, especially memecoin trading, is the furthest thing from fun. You buy a coin, you stare at a chart on your screen, and you probably lose money. There’s a reason why most people get burned out really quickly. Unless you’re making money, it’s one of the worst ways you can spend your time.

But what about Robinhood?

A lot of people know Robinhood as the retail degen WSB app, and it’s continuing to grow, so that must mean consumer crypto can also grow. But, although it does offer retail access to some cryptos and options, it’s still used by many people as a regular brokerage, and is really more like a financial superapp than a degen trading app. This is why it’s pushing products like Strategies, IRA’s, and Gold.

In this way, it’s more like Coinbase than Moonshot or Vector. People can actively trade on Coinbase, but it’s mostly used as an easy place to buy and hold. So, it’s definitely a consumer app, but not in the way that people typically think of crypto consumer.

So, what now?

Although I’m bearish on trading apps, I’m not bearish on the entirety of crypto consumer. I just think that the speculation aspect has to be one level deeper than simply memecoin trading. It has to be fun on its own and something closer to positive-sum. In other words, it has to be more like sports betting.

One app that does this well is Fantasy Top, a game where people bet on the performance of X influencers. It’s most definitely speculative, but it’s based on a game that is genuinely fun and skill-based. This keeps people coming back both because they enjoy it and they can actually make some money if they get good at it, a stark contrast to the torturous crapshoot that is memecoin trading.

Perhaps this is a lame answer. Just make better apps, people! But, if crypto consumer is to thrive, that’s the unfortunate truth. We need to do better than simple trading apps, and I’m trying to do my part with Phyt.

Of course, this is all contingent on the VCs being willing to fund apps that look a little weird at first.